Why Living Overseas Is Better pt 1- Financial Benefits

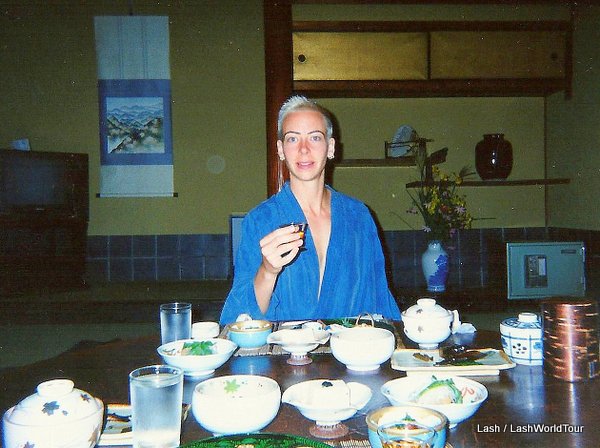

I first left the USA back in 1991. I moved to Kyoto, Japan specifically to save money to travel the world. Six years later, mission accomplished, I set out on my world trip. I’ve been traveling and living overseas ever since.

Needless to say, I’ve learned a heck of a lot about living and traveling in different countries. I’ve learned many eye-opening facts about such important things as costs of living around the world, health care, working overseas and life styles in various cultures.

My overwhelming and unhesitating conclusion is that living overseas is much better – for Americans at least – than living Stateside. That’s precisely why I’m still out here living and traveling the world!

Living outside the US has heaps of benefits that range from less expensive merchandise and food, better and cheaper health care, more state-of-the-art electronics, better internet access, much lower taxes, to a more diverse and culturally interesting daily life.

In fact, living overseas has so many bonuses that I’ve decided to write an entire series on Why It’s Better to Live Overseas.

Here in pt 1 I focus on the financial benefits of living overseas.

American taxes are much lower for expatriates

American citizens living overseas (expatriates) are exempt from paying US taxes on the first $80,000 US of income (or equivalent in whichever currency you’re earning your salary).

Yes, that’s right my fellow Americans! The first $80,000 of yearly salary you earn is legally tax free from any US taxes. Simply by living overseas instead of on US soil.

What’s your current salary? How’d you like to not have to hand over 20-30% of your income to the US government? How’d you like to keep that 20-30% of your hard-working salary instead of seeing it snatched away in taxes before your money lands in your own hands?

Do you realize how much larger your take-home pay would be? With an $80,000 salary, you’d have an extra $16,000 – $24,000 US per year. On a $40,000 salary, you’d have an extra $8000-10,000. For doing the same job. That’s pretty awesome!

Wait, it gets better:

Any income above $80,000 is taxed as usual, but by basing your income on that starting amount, excluding the initial $80,000.

For example, let’s say you earn $100,000. You will be taxed as if your income were $20,000. That puts you in a lower tax bracket than someone being taxed on $100,000. So in addition to paying zero tax on the first $80,000, you get a second tax break, of sorts, by having to pay less tax on that remaining income.

Paying taxes to your hosted country

You will be obligated to pay expatriate taxes on your income to the country where you’re working. But those taxes are often much much lower than US taxes. For instance, while I worked in Japan for six years I paid Japanese taxes on my income to the tune of less than 10%.

Prior to working in Japan, I had lived and worked in the USA just like most other Americans. For years I had watched 25% of my income disappear to taxes before I was handed what was left. Knowing that a huge chunk of my tax dollars was being used for military spending and that I probably would never be paid back the social security taxes I was handing over, I was not very happy giving the US government my hard earned money!

After that experience, receiving pay checks in Japan was amazing. It seemed like such a tiny little bit of money was removed from my pay for taxes. And in fact, 10% was less than half of what I’d been used to paying. It WAS significantly less.

Access to offshore banking

Americans living overseas have access to offshore banking. Offshore banks provide a lot of benefits to their customers above and beyond regular banks. Some benefits are access to much lower interest rates for investment purchases, potentially higher interest rates on savings accounts, and access to financial investments all over the world.

Of course you do need to follow correct legal procedures if you own an offshore account. For starters, you have to report any interest earned on your account to the IRS each year, just like reporting interest earned from any American bank accounts or other financial investments.

International currencies have higher value than $ US

In this decade, many other countries currencies have higher value than $ US. The US dollar has lost value against other currencies and will most likely continue to do so.

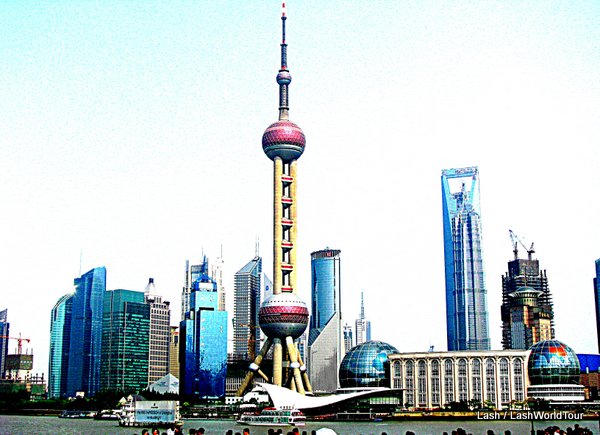

What this means is that if you work in any European countries, UK or Japan, you’ll be earning money that has more value. If you want to travel, that money will exchange into more local money than you’d get if exchanging $ US. Your money will go further. It will also go further if you visit the US.

Besides Europe, UK and Japan, several other countries’ currencies hold strong against the $ US – Australia, Thailand, Singapore, Malaysia, among others. If you live/ work in these countries, you’ll have the same currency benefits.

Medical care and health insurance are covered

Your health insurance and/or medical care will most likely be covered for you if you’re working in another country. In some countries, like Japan, health insurance is mandatory but is paid for by your employer. In my case, the English school that hired me and provided my work visa was also obligated to pay my health insurance. Saweet!

That’s one of the first and only times in my life I’ve been able to ‘afford’ health insurance. I certainly did not have health insurance when I worked in the US, except for a few years when my employer paid half.

In other countries, your medical needs could be completely covered by that country’s medical system. In many European countries, your income taxes cover all your medical care, in addition to other citizen benefits. If you’re working and residing in the country, you’ll be covered too, even though you’re not a citizen.

How much do you currently pay monthly for health insurance in the USA?

How’d you like to see that hefty bill disappear? How’d you like to have all your medical expenses covered, anytime, every time you need to visit the doctor or hospital?

But I’ll get into that more later in this series: Why It’s Better to Live Overseas – Health Care

Free housing and/or transportation

Your housing and/or transportation costs may be covered by your employer too. Expats working for large companies often enjoy another wonderful perk from being placed overseas: free housing. Big companies routinely put their expat employees up in lush condos, homes or apartments. Imagine not having to pay any rent or mortgage!

In Japan, companies routinely pay their employees home-to-work transportation fees. Since transportation is extremely expensive in Japan, having the company pay your way to/from work saves another big chunk of money.

Lower costs of living

Lower cost of living, less expensive food, less expensive products, less expensive communications are all more great perks of living in many countries around the world. But I’ll get into that with many concrete examples in the next post in this series of Why Living Overseas Is Better: Lower Costs of Living

As you can see, simply by relocating outside the United States, you can keep a much larger chunk of your salary and also save yourself huge amounts of money on major expenses like health insurance, housing and/or transportation.

Join the rest of my series in early 2013 on Why Living Overseas Is Better:

pt 2 Lower Crime / Higher Safety

pt 3 Less Expensive and Better Health Care

pt 4 Better, Faster and Less Expensive Communications: phone, internet, electronics

pt 5 Diversity of people, culture and daily life

(check here to learn more about this post)

——————————————————————————————————————————————

QUESTIONS:

Have you lived overseas?

What were your experiences, in terms of costs and finances?

Can you add any other financial benefits of living overseas?

————————————————————————————————————————————————-

Hi! I'm Lash, an American nomadic world traveler who's been traveling solo since 1998. I’m passionate about traveling the world nomadically and then sharing it all with you. I hope to inspire you to travel the world, to entertain you with tales from the road, and to help you reach your travel dreams. Welcome!

Hi! I'm Lash, an American nomadic world traveler who's been traveling solo since 1998. I’m passionate about traveling the world nomadically and then sharing it all with you. I hope to inspire you to travel the world, to entertain you with tales from the road, and to help you reach your travel dreams. Welcome!

5 pings

Why Living Overseas is Better pt 2 - Lower Crime / Higher Safety -Lash » LashWorldTour

2013/01/18 at 1:54 pm (UTC 8) Link to this comment

[…] and therefore feeling safe is one of the best reasons why Living Overseas is Better.See pt 1 of Why Living Overseas is Better – Financial Benefits Catch the rest of this series Why Living Overseas is Better, coming up […]